Northern Ireland Lags for Claiming R&D Tax Relief

Increasing National Inovation

R&D tax relief intends to increase national innovation and economic growth by providing cash refunds or offsets to eligible businesses, depending on whether the company is making a profit or loss.

Don’t Miss Out On Tax Relief

According to HMRC, companies in Northern Ireland are missing out on substantial amounts of R&D tax relief. The region accounted for just 3% of total claims and 1.6% of the total tax benefits claimed in the UK, totalling £45 million in 2016. By comparison, South East England claimed £570 million.

A Huge Win for Small Businesses

Data shows that 82% of the tax claims came from small businesses, with an average refund per claim of £57,000.

Northern Ireland Seeing Large Increases

While lagging behind other areas of the UK, Northern Ireland has increased their total value of tax credits claimed since 2015 by 29 percent. However, most of Ireland’s innovation spending is imported, so non-Irish firms are benefitting the most from the tax credit.

R&D Tax Relief Available to Many Industries

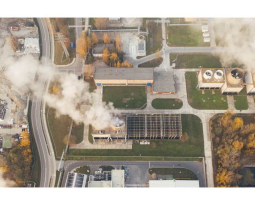

One reason that fewer companies apply for the credit may be a lack of awareness. The majority of the region’s claims come from the manufacturing, communication and professional, scientific and technical industries. Many companies do not realise that R&D tax relief is not purely aimed at traditional research and high-tech companies like pharmaceuticals. It is in fact available for industries including agriculture, building, energy and water.

No Need for Stress or Confusion

Claiming R&D tax credits need not be stressful or confusing. For assistance in claiming, please contact Swanson Reed R&D Tax Advisors, who can ensure that you are claiming what you are entitled to.